Mastering Money Matters: Elevate Your Success with Financial Services

Welcome to the world of financial services! Whether you're an aspiring entrepreneur, a seasoned investor, or simply looking to make smarter decisions with your money, mastering the ins and outs of finance services is essential for reaching unprecedented levels of success. In today's fast-paced and ever-evolving economic landscape, having a solid understanding of financial services can be the key to unlocking a world of opportunities and securing a prosperous future.

By leveraging the vast array of financial services available to individuals and businesses alike, you can navigate the complexities of the financial world with confidence and ease. From budgeting and investing to retirement planning and wealth management, these services offer tailored solutions to help you achieve your financial goals and build a stable foundation for long-term success. So, let's explore how you can harness the power of finance services to elevate your financial wellbeing and pave the way for a brighter tomorrow.

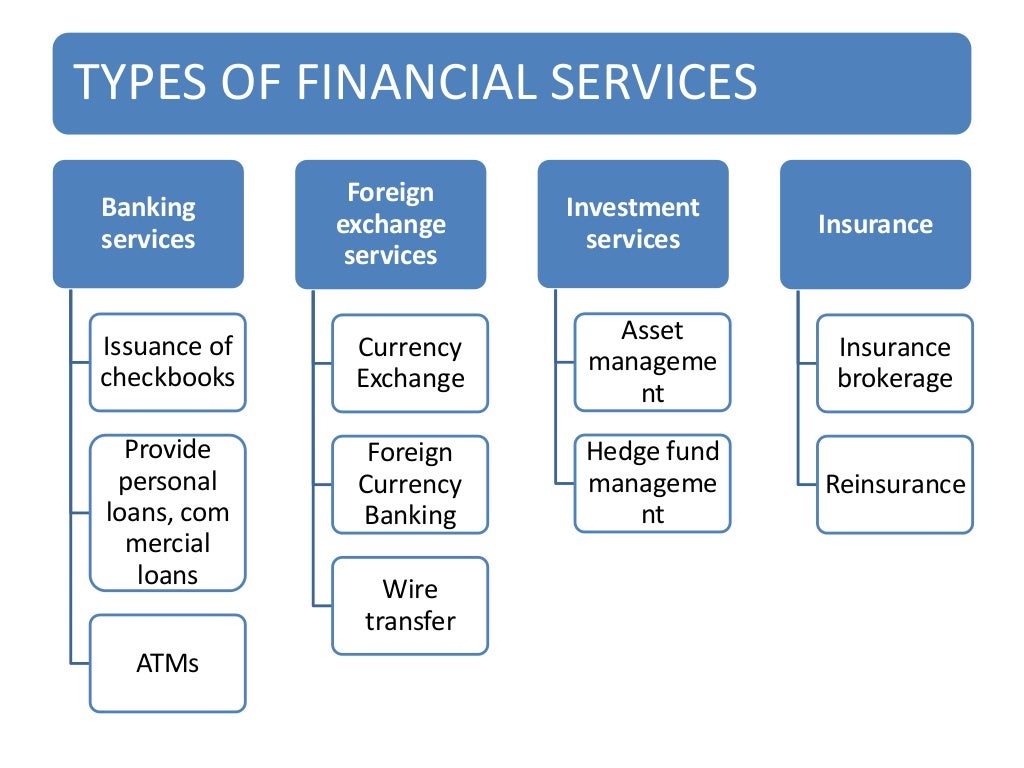

Types of Financial Services

When it comes to managing your finances effectively, having a clear understanding of the various finance services available can make all the difference. These services are designed to assist individuals and businesses in optimizing their financial resources, whether it be for investment, savings, or budgeting purposes.

One common type of financial service is banking, which provides a range of services such as checking and savings accounts, loans, and credit cards. Banks act as a hub for financial transactions, offering security and convenience to customers looking to manage their money efficiently.

Another essential financial service is investment management, where professionals oversee and grow your investment portfolio based on your financial goals and risk tolerance. This service helps individuals build wealth over time by making informed investment decisions tailored to their specific needs and circumstances.

Benefits of Utilizing Financial Services

Financial services offer numerous advantages to individuals and businesses alike. One key benefit is access to expert advice and guidance on managing money effectively. With the help of financial professionals, you can make informed decisions regarding investments, savings, and budgeting strategies.

Another significant advantage of utilizing finance services is the ability to customize financial solutions to meet your specific needs and goals. Whether you are planning for retirement, saving for a major purchase, or looking to grow your wealth, financial services providers can tailor their offerings to help you achieve your financial objectives.

Furthermore, leveraging financial services can lead to improved financial security and peace of mind. By entrusting your financial matters to professionals, you can mitigate risks, minimize potential losses, and ensure that your resources are managed prudently. This sense of security allows you to focus on other aspects of your life knowing that your financial well-being is in capable hands.

Choosing the Right Financial Service Provider

Firstly, when considering a financial service provider, it is crucial to assess your specific needs and goals. Take the time to identify what areas of your financial life require attention, whether it be investment management, retirement planning, or debt consolidation.

Next, research potential providers thoroughly to ensure they have the expertise and experience to meet your requirements. Look for reputable institutions with a track record of success and positive client feedback. Consider asking for referrals from trusted sources to help you make an informed decision.

Lastly, schedule consultations with a few selected providers to discuss your financial situation and assess how well they understand your needs. Pay attention to their communication style, level of attentiveness, and the solutions they propose. Ultimately, choose a financial service provider you feel comfortable with and confident in their ability to help you achieve your financial goals.